The New Geometric Paradigm for Systemic Risk

The EconoSysmographe is a scientific instrument developed by Trident AI to detect structural market fatigue. By utilizing the Universe Risk Framework (URF) and Riemannian Manifolds, we identify regime shifts before they manifest in price volatility.

Protecting Performance in a Non-Linear World

The Silent Cost of Tail Risk The financial crises of 2008, 2020, and the structural shifts of 2021 have proven one thing: by the time volatility spikes, it is already too late to hedge. For Asset Managers, these “Black Swan” events don’t just erase yearly gains; they cause permanent capital impairment and trigger massive institutional outflows.

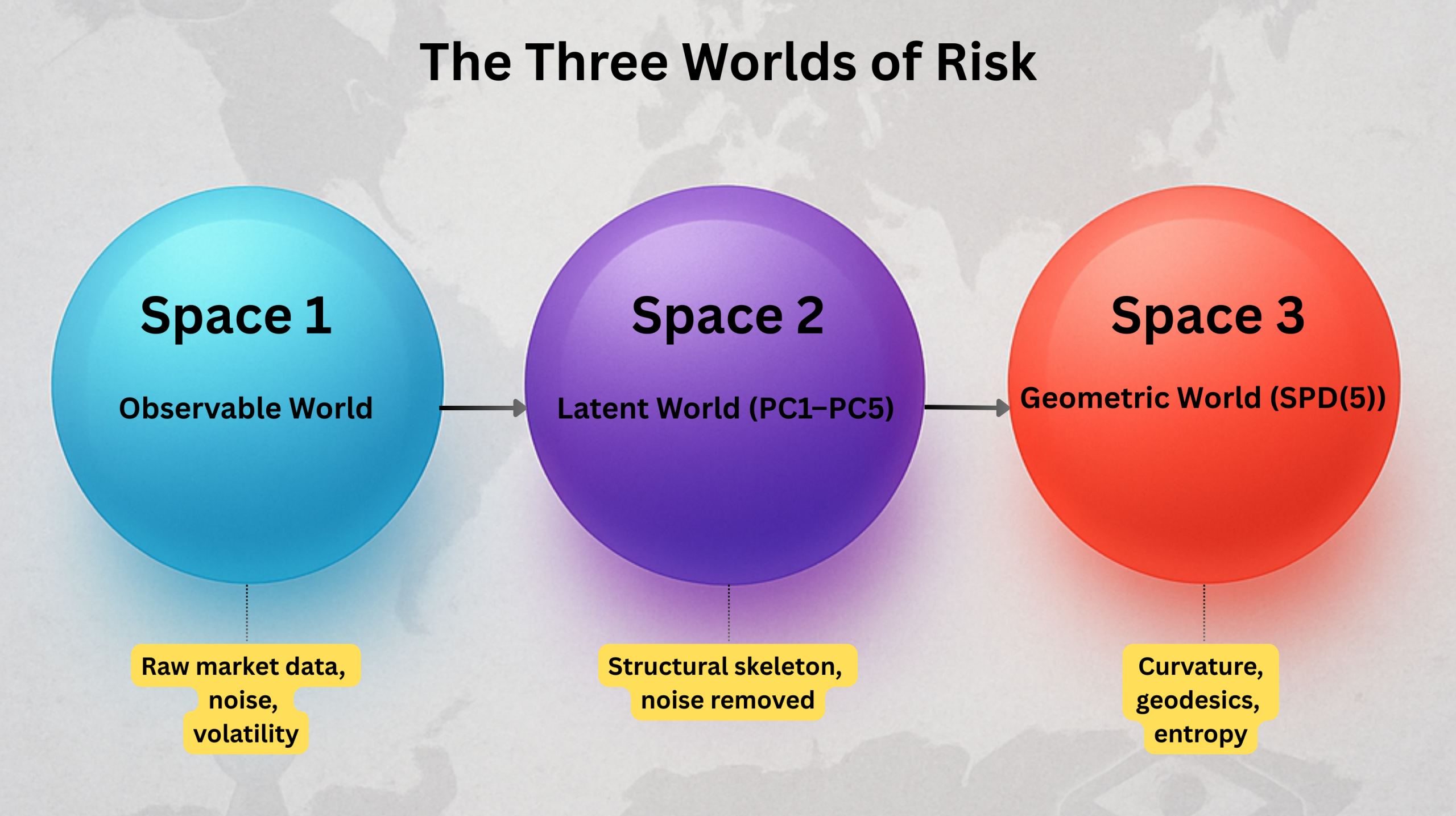

Beyond Traditional Volatility Standard risk models (VaR, Sharpe) often fail because they treat markets as linear systems. They are blind to the “structural fatigue” that precedes a crash. The EconoSysmographe™ changes the perspective.

How We Help Asset Managers:

- Early Fatigue Detection: Identify when market manifolds are losing resilience before the price drop.

- Dynamic Asset Allocation: Optimize exposure based on the curvature of systemic risk, not just past correlations.

- Preservation of Alpha: Protect your performance during regime shifts by detecting the transition from “Normal” to “Geometric” risk.

“In a world of increasing systemic fragility, the most expensive risk is the one your models cannot see.”

Discover the EconoSysmographe and become an early adopter

Be among the first institutional partners to integrate the Universe Risk Framework into your investment strategy. Gain a geometric edge on systemic risk detection before it becomes market standard.

Research & Downloads

The Universe Risk Framework (URF)

| The Universe Risk Framework (URF) | Geometric Foundations of the EconoSysmographe. Mapping risk through Riemannian manifolds. |